Cryptocurrency staking, a process where individuals lock up their digital assets to support blockchain networks and earn rewards, has garnered significant attention in the world of finance.

However, the complexities of how staking is taxed can be a daunting prospect for many. In this comprehensive blog post, we will embark on a journey to demystify the concept of crypto staking taxation.

We’ll explore not only the basics but also delve into the intricacies, providing you with the knowledge and insights needed to navigate this financial landscape effectively.

By the end of this article, you’ll be equipped with the tools to make informed decisions regarding your crypto activities and their fiscal implications.

Understanding Crypto Staking

To comprehend the tax implications of crypto staking, we must first grasp the fundamental concept itself. Crypto staking involves participants, often referred to as “stakers,” locking up their digital tokens within a blockchain network.

Their primary role is to validate transactions and contribute to the security and functionality of the network. In return for their commitment, these stakers are rewarded with additional tokens or coins.

Unlike crypto trading, which involves buying and selling assets for short-term gains, this activity is akin to earning interest on savings.

It requires a long-term commitment to a specific cryptocurrency, reinforcing the importance of understanding its taxation. If you want to get into it before reading about the taxation intricacies you should click here.

Why Does Staking Get Taxed?

The Internal Revenue Service (IRS) in the United States views staking rewards as taxable income. This perspective arises from the IRS’s consideration of crypto staking as a form of income, akin to conventional earnings like salaries or dividends from stocks.

This viewpoint is essential for maintaining fairness in the fiscal system, ensuring that individuals contribute their equitable share to government revenue. Furthermore, it emphasizes the significance of accurately reporting crypto activities.

Failure to do so can result in penalties or legal consequences, making it imperative for crypto enthusiasts to be well-informed about the monetary implications of this process.

Taxation on Staking Rewards

When it comes to the taxation of staking rewards, it’s crucial to understand the mechanics. Staking rewards are subject to federal taxation, and the applicable fiscal rate varies depending on an individual’s income bracket.

These rates can range from as low as 10% to as high as 37%. Therefore, it’s essential to calculate your overall liability by considering your total income, which includes the rewards earned from staking. However, accurate reporting of any crypto activities is not the only concern; maintaining precise records is equally vital.

Keeping Records

The importance of meticulous record-keeping cannot be overstated in the realm of crypto staking. To meet tax compliance requirements and ensure transparency in financial transactions, individuals engaging in staking must maintain accurate records.

This includes recording essential details such as the dates of staking, the amounts staked, and the rewards received. Keeping a comprehensive record of these transactions is invaluable when calculating your fiscal obligations.

It not only facilitates accurate reporting but also helps in demonstrating compliance with legal regulations, should the need arise for verification.

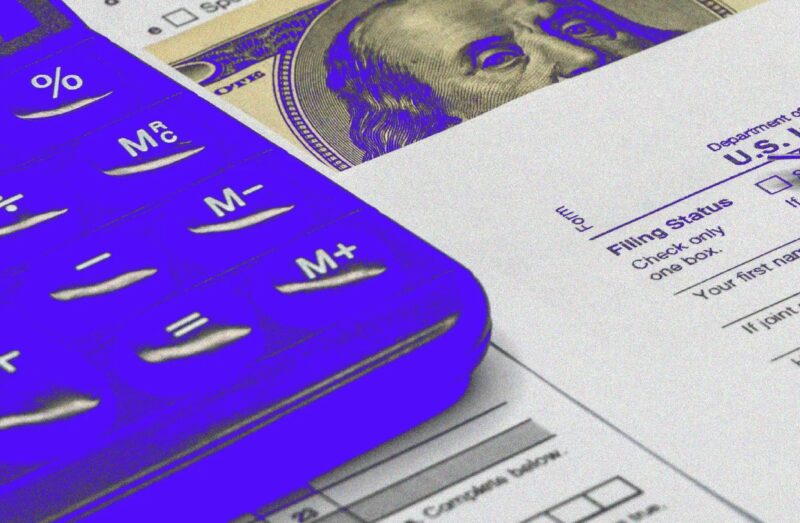

Tax Forms for Crypto Staking

Understanding the relevant tax forms for reporting staking income is a critical aspect of fulfilling your fiscal obligations. The IRS provides specific forms, such as Form 1040 or Form 1099, for reporting crypto income from this activity.

These forms serve as the medium through which you declare your earnings from staking, ensuring transparency and accountability in your financial activities. Accessing these forms is relatively straightforward; they can be found on the official IRS website or through various monetary preparation software.

Selecting the appropriate form and following the provided instructions is essential for accurate reporting.

Long-term vs. Short-term Capital Gains

Distinguishing between long-term and short-term capital gains is a crucial aspect of managing your tax liability in crypto staking. The classification depends on the duration for which you hold your staked assets.

Long-term gains apply to assets held for more than a year, while short-term gains pertain to assets held for a year or less. Importantly, the duration of your staking activity can significantly impact the tax rate you are subject to.

Understanding this distinction can potentially lead to substantial monetary savings, making it a compelling consideration for those engaged in staking activities.

Tax Reduction Strategies

Reducing tax liabilities associated with crypto staking is a prudent financial move. Several strategies can be employed to achieve this goal while staying within the bounds of legal regulations.

One effective approach is to consider tax-efficient holding periods. The optimal holding period varies depending on individual financial goals and personal circumstances.

To determine the best strategy for your specific situation, consulting with a financial professional is advisable. They can provide personalized guidance and help you navigate the complexities of tax reduction effectively, maximizing your financial benefits.

Dealing with Losses

While crypto staking offers the potential for rewards, it is not without its risks. Stakers may encounter losses, and knowing how to handle these losses for tax purposes is essential.

Fortunately, losses incurred in staking activities can be used to offset taxable gains, potentially reducing your overall tax liability.

This means that even in the face of financial setbacks, there is an opportunity to mitigate tax burdens through prudent financial planning and reporting.

Common Tax Mistakes to Avoid

In the world of crypto staking taxation, there are common pitfalls that individuals should be aware of to ensure accurate and responsible reporting. These mistakes include underreporting income, failure to maintain accurate records, and misinterpretation of laws.

It’s crucial to educate yourself about these potential errors and seek professional advice when necessary. The consequences of making such mistakes can be severe, including fines, penalties, or legal actions.

Protecting your financial well-being and maintaining compliance with legal regulations is paramount.

Consulting a Tax Professional

Navigating the intricate landscape of crypto staking taxation can be a daunting task. As such, it is highly advisable to seek expert guidance from a financial professional with expertise in cryptocurrency taxation.

These professionals can offer invaluable assistance in accurately reporting your staking income, optimizing your tax strategy, and ensuring compliance with legal regulations.

Their expertise can save you both time and money, helping you make informed financial decisions and navigate the complexities of the monetary system effectively.

Conclusion

In summary, crypto staking is a promising avenue for earning passive income through blockchain networks. However, it comes with a set of tax obligations that require careful consideration and responsible reporting.

It is important to understand the basics, keeping meticulous records, utilizing the right tax forms, and exploring strategies for tax reduction.

Related Posts:

- Obtaining The Skilled Worker Sponsorship Licence: 8…

- How to Calculate Long-Term Disability Premium: Legal…

- Social Media Management Strategies for Building a…

- How to Naturally Increase Fertility: Top Tips and Strategies

- 12 Tips for Calculating the Right Digital Marketing…

- 12 Tips to Transform Your Online Presence Through…